Investors and operators alike believe the market’s growing numbers should continue into the next year.

Overall, the cannabis industry has much to be optimistic about as 2022 approaches. The U.S. industry, in particular, should be enthusiastic despite its remaining required maturation.

Operators across numerous pot sectors told Benzinga what they are most optimistic about for 2022. These were the four most discussed topics.

Legalization Helps Grow Sales, Further Erodes Stigmas

Cannabis reform progress continued across much of the country in 2021.

Nine states passed decriminalization, medical use, or adult-use laws in 2021. Numerous other states reformed their regulations through legislative means this year.

Despite various bills making progress on the state level this year, federal law remains the same, though the House of Representatives once again approved the SAFE Banking Act and the MORE Act.

“No matter how long it takes to legalize cannabis on a federal level, as a country, we’ve definitely been making significant inroads on the path towards cannabis liberalization,” said Andrew Thut, chief Investment officer of 4Front Ventures Corp.

Thut said he hopes to see more states pass social equity measures when reforming cannabis laws.

Tom Bruggemann, CEO and inventor for ag-tech brand Tom’s Tumble Trimmer said reform helps promote the plant’s social acceptance. He expects acceptance to grow in 2022, leading to increased retail demand.

Calling the moment “exciting,” Bruggemann believes consumers will look beyond big brands. “As many consumers wish to support independent farmers rather than corporations, the market will continue to thrive with private operations next year and beyond,” Bruggemann predicted.

A Growing Market Drives Consumer Demand

Investors and operators alike believe the market’s growing numbers should continue in 2022.

In a November interview for a previous article, Brian Jansen, president of Bellrock Brands Inc., said he liked the market’s momentum.

“I am confident we will see continued normalization across the country in the next twelve months,” he said.

Todd Green, director of investor relations at Jushi Holdings Inc., offered a similar take. “I’m looking forward to watching the cannabis industry continue to balloon, foster and maintain more careers, and expand access across the country,” he said.

In November, Morgan Paxhia, managing director at Poseidon Investment Management, told Benzinga that he was also eager for expansion, saying, “We are looking forward to new market expansion in 2022, supporting an uptick in overall growth in the US after a mid-cycle slowdown.”

He added that tax rates should come down and states revisit regulations.

Continuing Tech Innovations

Cannabis tech continues to be introduced and refined, affecting sectors from cultivation to compliance and much more. Several operators said 2022 will be a significant year for their tech spaces.

Marion Mariathasan, co-founder and CEO of regulatory and operational compliance software platform Simplifya, believes that 2022 is the year reg-tech takes center stage.

“Reg-tech has the potential to play a critical role in streamlining the challenges that ultimately pop up when working in a constantly changing, fractured regulatory environment,” he said.

Mariathasan added that tech expansions allow banks and other ancillary services to work and comply with the high-risk sector.

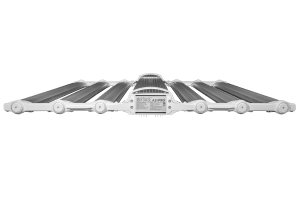

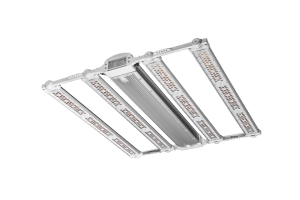

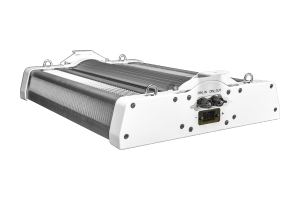

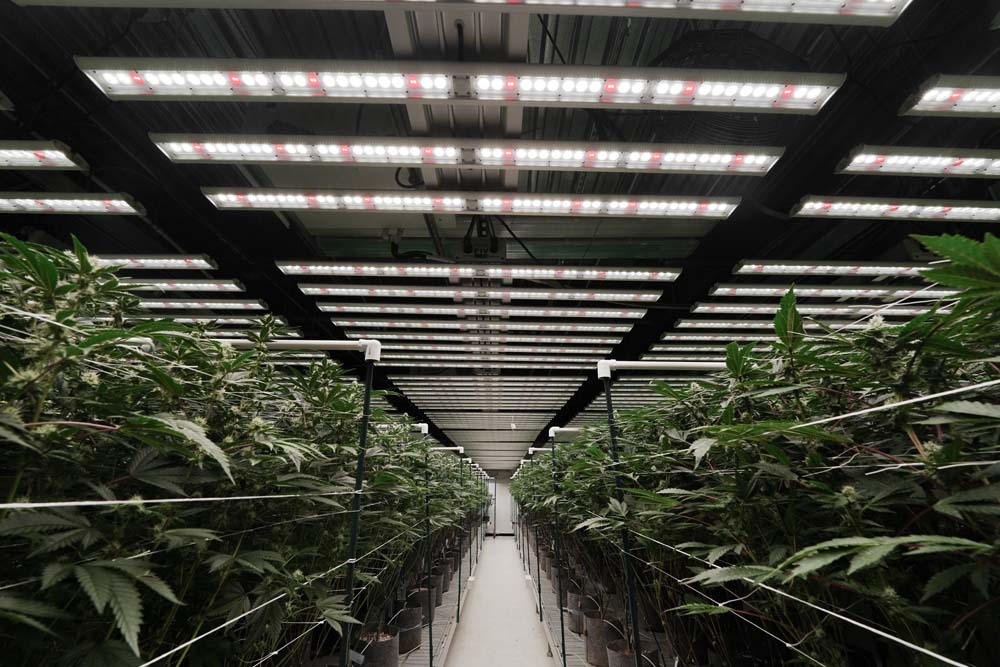

Brett Stevens, CEO of LED grow light company Fohse said an increased focus on sustainability means more states could take up legislation to eliminate HPS (high-pressure sodium) lights.

“As an emerging industry, we must set standards and try and create better products that are more sustainable,” Stevens said.

In 2021, Fohse saw its revenue grow by a reported 510%. It also partnered with Belushi Farms to fit its Rogue Valley site with LED grow lights.

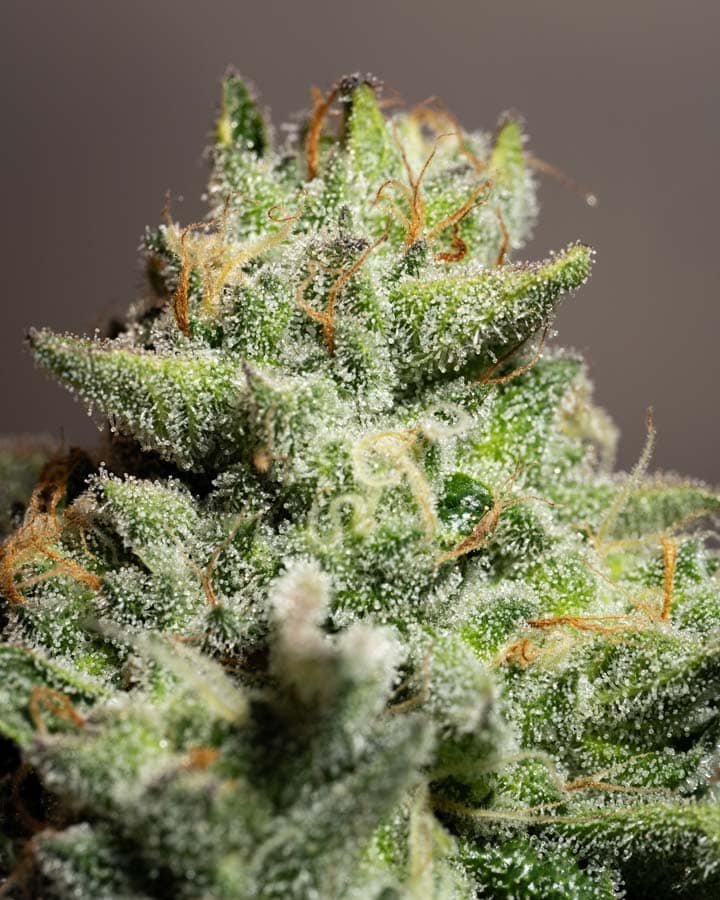

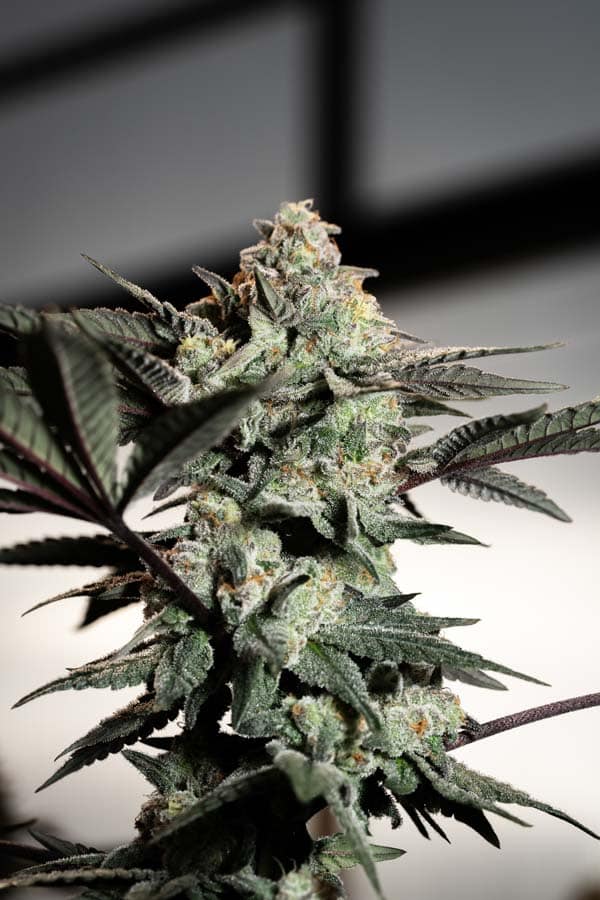

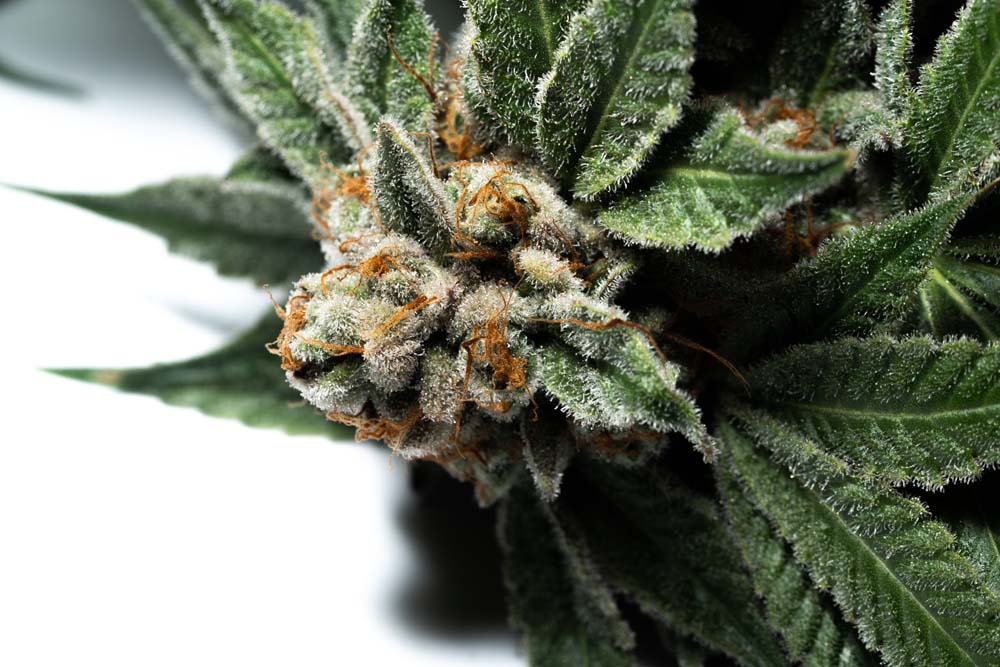

Production Shifting Towards Full Spectrum, Solventless

Sources say that product developments continue as brands compete to enhance consumer experiences and meet shifting market demands.

Lo Friesen, founder and CEO of Seattle-based extraction brand Heylo, noted that consumers are becoming more educated about THC content and whole plant experiences. The uptick in education leads to a reported shift in production processes.

Still, market education remains. “Cannabis dispensaries and consumers continue to fixate on THC content as a measure of potency, a practice that yields subpar experiences and limits the potential effects that can be obtained by consumers,” Friesen said.

Christine Shollenberger, VP of marketing for Michigan-based brand Fluresh, is thrilled to see fast-acting edibles and other products growing in popularity.

“As more states legalize and more new consumers enter the market, product offerings for fast-acting products will continue to exponentially grow,” she predicted.

Shollenberger said she believes further reform will increase interest in premium craft products made from live resin, full-spectrum and solventless extracts.

![[WEBINAR] Capturing ALL Wasted Spend Lighting Your Greenhouse](https://resources.fohse.com/wp-content/uploads/2021/12/Screen-Shot-2021-12-17-at-11.09.46-AM.png)

![Client [HIGH]💡 | Terp Mansion](https://resources.fohse.com/wp-content/uploads/2024/05/Terp-Mansion-Best-Of-2.8.24-WEB-45.jpg)